Question ❓

Our firm made an initial investment of 90,000 TL in year 0 and will begin operations in year 1. Out of the 90,000 TL:

- 40,000 TL is financed through a bank loan with an interest rate of 12% and a payback period of 6 years.

- The remaining amount is financed by shareholders’ equity, which has a cost of 16%.

The net cash flows over the years are as follows:

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Net Cash Flows | -90,000 | 30,000 | 40,000 | 50,000 | 30,000 | 15,000 | 15,000 |

Please apply the following six investment criteria:

- Payback Method (PM)

- Discounted Payback Method (DPM)

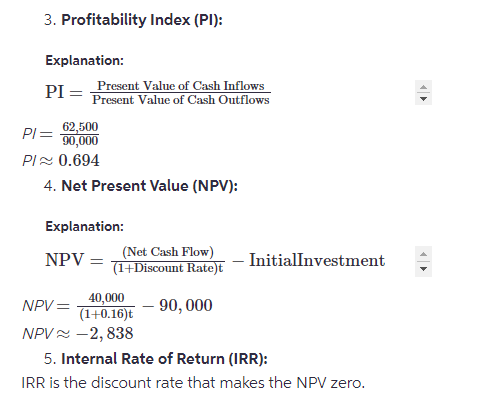

- Profitability Index (PI)

- Net Present Value (NPV)

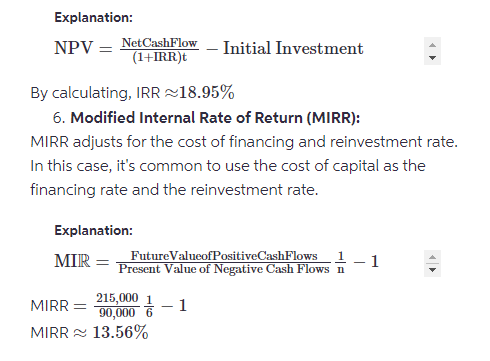

- Internal Rate of Return (IRR)

- Modified Internal Rate of Return (MIRR)

Solution ✅

Explanation:

we calculate each of the investment criteria based on the provided information:

- Payback Method (PM):

The payback period is the time it takes for the initial investment to be recovered.

Cumulative Cash Flow =40,000,70,000,120,000,170,000,200,000,215,000

Since the initial investment of 90,000 is recovered in year 2, the Payback Period is 2 years.

- Discounted Payback Method (DPM):

Similar to Payback Method, but with discounted cash flows.

Discounted Cumulative Cash Flow =40,000,62,500,98,214

Since the initial investment is recovered in year 3, the Discounted Payback Period is between years 2 and 3.

Final Answer

- Payback Method (PM): 2 years

- Discounted Payback Method (DPM): Between years 2 and 3

- Profitability Index (PI): Approximately 0.694

- Net Present Value (NPV): Approximately -2,838 TL

- Internal Rate of Return (IRR): Approximately 18.95%

- Modified Internal Rate of Return (MIRR): Approximately 13.56%