Using this 6criteria answe the question

1.Payback Method (PM)

2. Discounted Payback Method (DPM)

3. Profitability Index (PI)

4. Net Present Value (NPV)

5. Internal Rate of Return (IRR)

6. Modified Internal Rate of Return (MIRR)

Answer:−

Let’s proceed with a structured and precise approach for each step, including brief explanations.

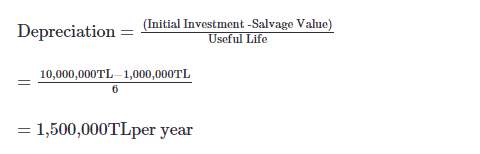

Depreciation Calculation

Explanation:

The straight-line method allocates the depreciable cost evenly over the asset’s useful life.

Net Cash Flow Statement Calculation

Year 0:

Investment = −10,000,000TL

Working Capital = −500,000TL

NCFYear0=Investment +Working Capital

=−10,000,000TL−500,000TL

=−10,500,000TL

Explanation:

Initial cash outflow includes the investment and the initial working capital.

For years 1 to 6, we calculate the cash flows as follows

Year 1

Income=8,000,000TL

Expenditure=25%×Income

=25%*8000000TL

=2000000TL

Taxable Income =Income-Expenditure-Depreciation

=80,000,000TL−2,000,000TL−1,500,000TL

=4,500,000TL

Tax =20%*Taxable Income

=20%×4,500,000TL

=900000TL

NCF Year 1=Income -Expenditure-Tax -Depreciation

=8,000,000TL−2,000,000TL−900,000TL−1,500,000TL

=3600000TL

Explanation:

Cash inflow is adjusted for operating costs, taxes, and depreciation.

Year 6

Include the Salvage Value and recovery of Working Capital

Salvage Value=1,000,000TL

Recovery of Working Capital=500,000TL

NCF Year 6=Calculated NCF+ Salvage Value+ Recovery of Working Capital

=[Income -Expenditure-Tax-Depreciation]+Salvage Value +Recovery of Working Capital

Explanation:

The final year cash flow includes the salvage value of the asset and the recovery of working capital.

Investment Criteria Calculations

Payback Method (PM)

The PM is calculated by summing the NCFs until the initial investment is recovered.

Discounted Payback Method (DPM)

The DPM discounts each NCF at the WACC and then sums them until the initial investment is recovered.

Profitability Index (PI)

PI = (Present Value of Future Cash Flows/Initial Investment)

Net Present Value (NPV)

NPV = ∑(NCFt(1+WACC)t)−Initial Investment

Internal Rate of Return (IRR)

Explanation:

The IRR is the rate (r) that makes the NPV equal to zero.

Net Cash Flow (NCF) Calculation

| Year | Income (TL) | Expenditure (25% of Income) | Taxable Income (TL) | Tax (20% of Taxable Income) | Depreciation (TL) | Net Cash Flow (NCF) (TL) |

| 0 | – | – | – | – | – | -10,500,000 |

| 1 | 8,000,000 | 2,000,000 | 4,500,000 | 900,000 | 1,500,000 | 3,600,000 |

| 2 | 9,000,000 | 2,250,000 | 5,250,000 | 1,050,000 | 1,500,000 | 4,200,000 |

| 3 | 10,000,000 | 2,500,000 | 6,000,000 | 1,200,000 | 1,500,000 | 4,800,000 |

| 4 | 6,000,000 | 1,500,000 | 3,000,000 | 600,000 | 1,500,000 | 2,400,000 |

| 5 | 4,000,000 | 1,000,000 | 1,500,000 | 300,000 | 1,500,000 | 700,000 |

| 6 | – | – | – | – | 1,500,000 | 0 |

Recovery of Working Capital = 500,000 TL

NCF Year 6 =Tax Saving+Salvage Value+Recovery of Working Capital

=300,000TL+1,000,000TL+500,000TL

=1,800,000TL

Final Net Cash Flow Table

| Year | NCF (TL) |

| 0 | -10,500,000 |

| 1 | 3,600,000 |

| 2 | 4,200,000 |

| 3 | 4,800,000 |

| 4 | 2,400,000 |

| 5 | 700,000 |

| 6 | 1,800,000 |

The final table shows the net cash flow for each year, including the recovery of the working capital and the salvage value in the final year.